In today’s unpredictable world, financial security is something everyone strives for. But despite the best of plans, life often throws unexpected challenges. Whether it’s a sudden medical emergency, a job loss, or an urgent need for home repairs, these situations can create significant stress if you’re not financially prepared. This is where an emergency fund becomes an essential part of your financial strategy.

So, what exactly is an emergency fund, and why is it crucial for you in India? Let’s dive in.

What is an Emergency Fund?

An emergency fund is a stash of money for urgent and unforeseen expenses. It’s a financial safety net that helps you tackle unexpected situations that could otherwise disrupt your financial well-being.

Life in India is not short of uncertainties. Unexpected events like a sudden medical emergency, a job layoff, or a family crisis can arise at any time, and without an emergency fund, you could end up relying on loans or credit cards to handle such situations — leading to financial stress.

The goal of an emergency fund is to cover essential expenses without compromising your day-to-day living or sinking you into debt. It helps provide peace of mind, knowing you have a financial cushion during tough times.

Why Do You Need an Emergency Fund in India?

Emergencies are a universal part of life, but in India, certain factors make an emergency fund even more crucial:

- Medical Emergencies: Health care costs in India can vary drastically, especially for urgent treatments or surgeries. While insurance can cover a significant portion of medical expenses, there can still be out-of-pocket costs, especially for non-network hospitals or expenses not covered by policies (like maternity or critical illnesses). In addition, many Indians do not have health insurance, making it even more important to have an emergency fund.

- Job Loss or Income Interruptions: While India’s job market offers opportunities, many people still face job instability or layoffs, especially during economic downturns or in sectors like IT, manufacturing, or retail. Without an emergency fund, losing your job or facing pay cuts could lead to major financial strain.

- Unforeseen Family Events: Sudden events like a family member’s wedding, medical crisis, or death could require urgent funds. In India, where extended families often live together or are closely knit, these events can demand both emotional and financial attention.

- Natural Disasters or Accidents: Floods, earthquakes, and other natural disasters are unfortunately a part of life in many parts of India. Having an emergency fund can help you quickly address the immediate needs that arise, such as repairs or relocation costs.Home Repairs and Vehicle Breakdowns: Major repairs to your home or car can arise unexpectedly, especially in older homes or vehicles. Whether it’s a leaking roof, faulty wiring, or a broken-down car, without an emergency fund, these repairs could lead to financial stress.

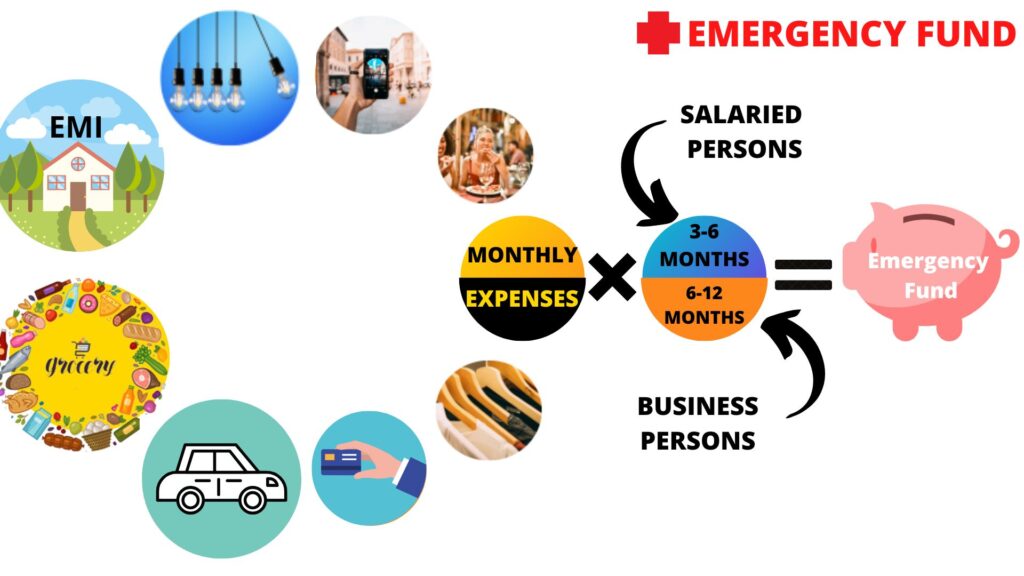

How Much Should You Save in an Emergency Fund?

The amount you need to save for your emergency fund depends on your lifestyle and financial obligations, but a general rule of thumb is to aim for three to six months’ worth of living expenses.

For instance, if you spend ₹30,000 per month on essential expenses like rent, groceries, utilities, transportation, and insurance, you should ideally save ₹90,000 to ₹1,80,000. This will allow you to cover your basic needs in case of job loss, health issues, or other emergencies.

However, certain factors might affect the amount you need:

How to Build Your Emergency Fund in India?

Start Small: Saving for an emergency fund can feel daunting, but you don’t need to build the entire amount in a few months. Start with a goal of saving ₹10,000, ₹20,000, or ₹50,000 depending on your situation. Gradually build up over time.

- Set a Monthly Savings Goal: Treat your emergency fund like any other bill. Set aside a fixed amount of money each month, no matter how small. For example, setting aside ₹5,000-₹10,000 every month can add up quickly over a year.

- Automate Savings: If you receive a salary or income regularly, you can set up an automatic transfer to a separate savings account every month. This ensures you don’t forget to save and helps you build your fund consistently.

- Cut Back on Non-Essential Spending: To accelerate your savings, look for ways to cut back on discretionary expenses. If you typically eat out a lot, reduce that. Or if you spend on subscriptions you don’t use, cancel them. Redirect the savings into your emergency fund.Increase Your Income: Consider side gigs, freelancing, or part-time jobs to increase your income and build your emergency fund faster. Even small extra earnings can make a big difference in building up that buffer.6

- Use the Right Savings Vehicle: It’s crucial to keep your emergency fund in an account that’s easily accessible but separate from your day-to-day spending. Opt for a high-interest savings account, a fixed deposit (if you don’t anticipate needing immediate access), or a liquid mutual fund. Avoid keeping the money in your regular checking account, as you might be tempted to spend it.

Where to Keep Your Emergency Fund in India?

- High-Interest Savings Accounts: Many banks offer high-interest savings accounts where you can park your emergency fund. These accounts offer higher returns compared to regular savings accounts and ensure liquidity, so you can access your funds quickly if needed.

- Liquid Mutual Funds: Liquid funds are a type of mutual fund that invests in short-term debt instruments. They offer higher returns than savings accounts, and the funds are usually available within a day or two when needed. They are a good option if you’re willing to take on slightly more risk for a better return.

- Fixed Deposits (FDs): Although FDs offer a fixed return, they usually come with a lock-in period. While it’s not the best option for short-term liquidity, you could use FDs if you have a portion of your emergency fund that you don’t foresee needing immediately.

- Recurring Deposit (RD): If you’re starting small and need a structured way to build your emergency fund, you can opt for a recurring deposit with a bank. This allows you to deposit a fixed amount every month, and you can withdraw it as needed.

Final Thoughts

Having an emergency fund is essential for anyone who wants to achieve financial security, and this is especially true for Indians in today’s dynamic economic environment. Whether it’s dealing with medical emergencies, job disruptions, or unexpected expenses, an emergency fund can be your lifeline when the unexpected strikes.

Start small, remain consistent, and gradually build your emergency fund over time. With careful planning and discipline, you can ensure that you’re financially prepared for life’s uncertainties giving you the confidence and peace of mind to face whatever comes your way.

Other Articles

How to do Financial Planning in Real Life?

EPFO Grievance: Step-by-Step Guide to Registering Your Grievance with EPFO

Understanding EPF Interest Rates: What You Need to Know

What is HRA and How to calculate and claim? What if you don’t receive HRA?