In recent years, a new way of investing in the stock market has gained significant popularity, especially among millennial and tech-savvy investors. This innovative method is known as Smallcase investment. But what exactly is it, and how can you start investing in it? Let’s dive into the details.

What is Smallcase Investment?

A Smallcase is essentially a basket of stocks or exchange-traded funds (ETFs) that are grouped together based on a specific theme, strategy, or objective. Unlike traditional investments where you buy individual stocks, a Smallcase allows you to invest in a collection of securities that align with your financial goals, risk appetite, or market perspective.

Each Smallcase is curated by financial experts, investment advisors, or analysts. The underlying idea is to provide a simplified and goal-oriented investment approach. For example, you might find Smallcases built around themes like electric mobility, dividend-paying stocks, or ESG (Environmental, Social, Governance) compliance.

The concept of Smallcase investments makes it easier for retail investors to diversify their portfolios without extensive research. Additionally, it ensures that your investments are aligned with a broader theme or trend in the market.

Benefits of Smallcase Investment

Here are some reasons why Smallcases have become a preferred choice for many investors:

- Thematic Investing: You can invest in trending themes, such as renewable energy or digital transformation, which might align with your personal beliefs or market outlook.

- Diversification: Since a Smallcase consists of multiple stocks or ETFs, it spreads risk across various securities, reducing the impact of a poor-performing stock on your portfolio.

- Transparency: You have complete visibility into the stocks and weightage within the Smallcase. This allows you to understand where your money is being invested.

- Flexibility: You can customize a Smallcase by adding or removing stocks, giving you control over your investments.

- Ease of Use: Smallcases are integrated with major brokerage platforms, making it convenient to buy, track, and manage your investments in one place.

How to Invest in Smallcases?

Investing in Smallcases is a straightforward process. Here are the steps to get started:

1. Choose a Broker

First, you need an account with a stockbroker that supports Smallcase investments. Many leading platforms like Zerodha, HDFC Securities, and Groww have integrated Smallcase functionality.

2. Log in to the Smallcase Platform

Once your brokerage account is ready, log in to the Smallcase platform through your broker’s portal or the Smallcase website. The platform will sync with your brokerage account.

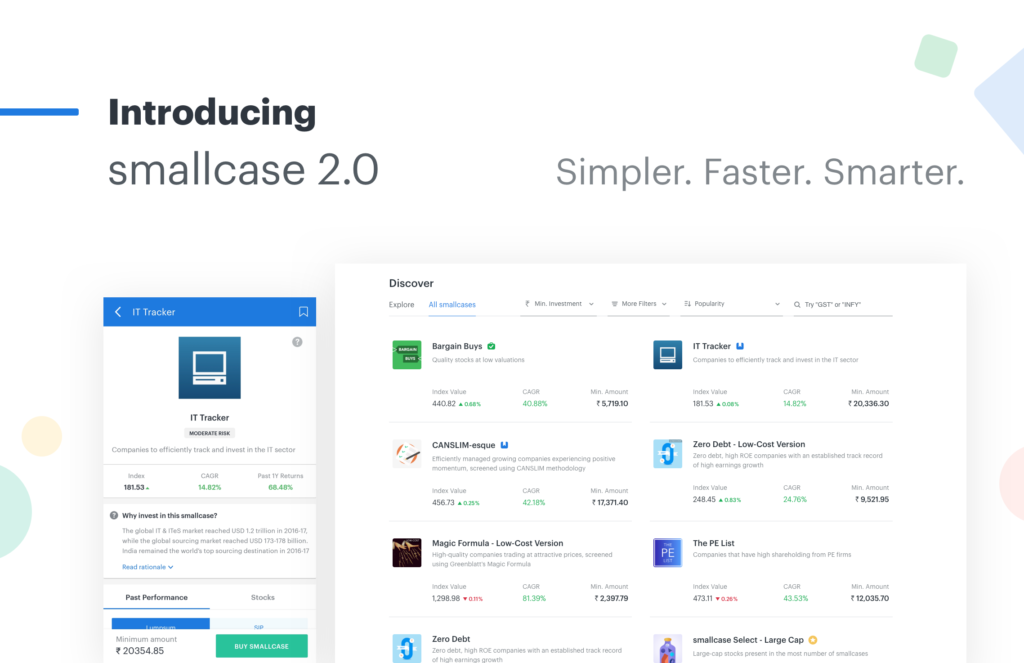

3. Browse and Select a Smallcase

Explore the available Smallcases based on your interests, financial goals, and risk tolerance. Each Smallcase displays information about its theme, historical performance, and the stocks it contains.

4. Analyze the Smallcase

Before investing, review the composition of the Smallcase. Understand its rationale, past returns, and the industries it represents. Most platforms also provide a detailed factsheet to help you make an informed decision.

5. Invest in the Smallcase

After finalizing your choice, you can invest in the Smallcase with a single click. The platform will execute the purchase of all underlying stocks in the specified proportions.

6. Track and Rebalance

Once invested, you can track the performance of your Smallcase through your brokerage account. Periodically, the Smallcase provider may suggest rebalancing to align with market conditions or the theme’s objectives. You can choose to accept or skip these updates.

Who Should Invest in Smallcases?

Smallcase investments are ideal for:

- 1. Beginners who want a simplified way to invest in the stock market.

- 2. Investors looking for a diversified portfolio with minimal effort.

- 3. Those who prefer thematic investing to align with their financial goals or interests.

- 4. Individuals seeking professional curation without the higher fees of mutual funds.

FAQs About Smallcase Investments

- What is a Smallcase? A Smallcase is a basket of stocks or ETFs grouped around a specific theme or strategy.

- How is Smallcase different from mutual funds? Smallcases offer more transparency, flexibility, and control compared to mutual funds.

- Can I customize a Smallcase? Yes, you can add or remove stocks from a Smallcase to suit your preferences.

- What is the minimum investment amount for Smallcases? The minimum amount depends on the price of the stocks in the Smallcase and their proportions.

- Are Smallcases suitable for beginners? Yes, they are beginner-friendly and simplify stock market investing.

- Can I exit a Smallcase anytime? Yes, you can exit a Smallcase partially or completely at any time.

- What is rebalancing in Smallcases? Rebalancing adjusts the portfolio’s composition to maintain its intended strategy.

- How often are Smallcases rebalanced? It varies by Smallcase and is determined by the provider’s strategy.

- Are there any charges for investing in Smallcases? Apart from brokerage fees, some Smallcases may have a subscription fee.

- Can I track my Smallcase performance? Yes, you can monitor performance through your brokerage account or the Smallcase platform.

- Do Smallcases provide dividends? Yes, if the stocks in the Smallcase declare dividends, you will receive them.

- Can I invest in multiple Smallcases? Absolutely, you can diversify further by investing in multiple Smallcases.

- Is there any risk in Smallcase investing? Like any stock market investment, Smallcases carry market risks.

- Who curates Smallcases? Financial experts, advisors, and analysts design Smallcases based on strategies or themes.

- Do I own the stocks in a Smallcase? Yes, you own the underlying stocks in your name.

- How do taxes work with Smallcase investments? Taxes are applicable on stock transactions as per existing capital gains rules.

- Are Smallcases better than direct stock picking? They simplify diversification and thematic investing, making them appealing to many.

- Can NRIs invest in Smallcases? Yes, NRIs can invest if they have an account with a supported broker.

- What happens if I don’t rebalance my Smallcase? Your portfolio may deviate from its intended strategy over time.

- Where can I learn more about Smallcases? Visit the Smallcase website or consult your broker for detailed insights.

Other Articles:

How can mutual-fund investors use MF Central? It’s Features?