Rent is a significant portion of an individual’s monthly expenses. To provide relief to salaried individuals who live in rented accommodations, the government of India introduced the House Rent Allowance. HRA is a component of the salary package that helps employees manage their rental expenses. In this blog, we will delve into what HRA is, how to calculate it, and how to claim it.

What is House Rent Allowance (HRA)?

House Rent Allowance (HRA) is a component of your Cost to Company (CTC) provided by your employer to assist you in meeting the expenses associated with residing in a rented accommodation.

Is HRA taxable?

Yes, House Rent Allowance (HRA) forms a component of your salary income, making it initially subject to taxation. However, residing in a rented accommodation opens the opportunity to claim a tax exemption, either partially or entirely, under Section 10(13A) of the Income Tax Act. Commonly referred to as HRA exemption, this provision allows individuals to mitigate their tax liability. In the absence of residing in a rented accommodation, the HRA allowance becomes fully taxable.

Eligibility Criteria to Claim Tax Deductions On HRA

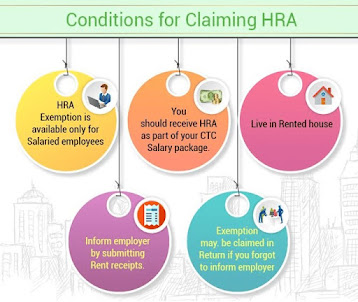

To claim tax deductions on House Rent Allowance, individuals must meet specific eligibility criteria outlined by the Income Tax Act. Here are the key factors determining eligibility for claiming HRA tax deductions:

- 1. Salaried Individuals:

HRA is generally a component of the salary package offered by employers. Therefore, only salaried individuals are eligible to claim HRA tax deductions.

2. Rented Accommodation:

To qualify for HRA deductions, the taxpayer must be living in a rented accommodation. HRA is intended to provide relief for individuals incurring rental expenses.

3. Salary Structure:

The individual should receive HRA as part of their salary structure. If HRA is not included in the salary package, the taxpayer cannot claim deductions for it.

4. Actual Payment of Rent:

To claim HRA benefits, the individual must actually pay rent for the accommodation. The rent paid should be a genuine expense and supported by relevant documentation such as rent receipts and lease agreements.

5. Ownership of House:

Taxpayers who own a house in the city where they work are not eligible for HRA deductions. HRA is specifically designed for individuals living in rented homes.

6. PAN Details of Landlord:

If the annual rent paid exceeds Rs. 1 lakh, the individual must provide the Permanent Account Number (PAN) details of the landlord to avail of HRA deductions.

7. No HRA Component in Salary:

In cases where the employer does not provide an HRA component in the salary structure, the individual cannot claim HRA deductions.

8. Proof of Rent Payment:

Proper documentation, including rent receipts and lease agreements, should be maintained to support the claim for HRA deductions. These documents serve as evidence of the actual rent paid.

9. Living in Metro/Non-Metro Cities:

The amount of HRA exemption depends on whether the individual resides in a metro city or a non-metro city. Different percentages are applied to the salary for calculation purposes.

10. Declaration in Tax Declarations:

The individual must declare the HRA component in the tax declaration submitted to the employer at the beginning of the financial year.

11. HRA exemption is allowed under the old regime only

The employee should opt for the old regime to take the benefit of HRA exemption.

Meeting these eligibility criteria is crucial for individuals seeking to avail of tax deductions on HRA. By adhering to these conditions and providing the necessary documentation, taxpayers can ensure compliance with the regulations outlined in the Income Tax Act and maximize their tax benefits.

How to calculate HRA Exemption?

HRA tax exemption depends on four components:

How to calculate HRA Exemption?

The HRA calculation is based on various factors, and it’s crucial to understand the components involved. The HRA amount is generally determined using the following formula:

HRA = Actual HRA received – (10% of Basic Salary + Dearness Allowance) – 50% of the Basic Salary if living in metro cities (or 40% for non-metro cities)

Let’s break down the components:

1. Actual HRA Received: This is the total HRA amount provided by the employer.

2. 10% of Basic Salary + Dearness Allowance: This is the portion of the basic salary and dearness allowance that is exempt from tax.

3. 50% of Basic Salary (or 40% for non-metro cities): This is the maximum HRA exemption allowed under the Income Tax Act. If the actual HRA received is less than this calculated amount, the lower figure will be considered for exemption.

Example:

Now, let’s consider that your monthly rent in a city like Bangalore is Rs. 20,000. Your HRA calculation is as follows:

1. Actual HRA- 1.8 lakh per year

2. 40% of your Basic Salary- 40% of 50,000, multiplied by 12 = 2.4 lakh

3. Actual rent minus 10% of Basic Salary = 20,000 x 12 – 10% of 6 lakhs = 1.8 lakh

To determine the minimum of these three values, which is used for tax calculation, it is Rs. 1.8 lakh. Therefore, only 1.8 lakh is non-taxable. You can deduct only this amount from your taxable income. Although the actual rent paid is 2.4 lakh, the tax benefit is limited to the minimum of these calculations.

What if you don’t receive HRA? Or How to Claim Deduction Under Section 80GG?

If you’re not getting HRA but you’re renting, you can still get a deduction on the rent you pay. This is covered under section 80GG of the Income Tax Act 1961, but there are conditions to meet.

The maximum deduction you can claim under section 80GG is the lower of these three options:

1. Rs. 5,000 per month or Rs. 60,000 per year.

2. 25% of your Gross Total Income (excluding certain income types and deductions).

3. Actual Rent paid minus 10% of your Income.

In summary, understanding HRA and its tax impact is crucial for those who earn a salary. HRA helps with rent expenses and can save you on Income Tax. If you’re eligible for HRA, you can claim exemptions under Section 10(13A). If not, you can still get deductions under Section 80GG. It’s important to follow the conditions specified in the Income Tax Act to ensure accurate and legal tax benefits related to HRA.

Other Articles:

EPF Withdrawal- How to Navigate the EPF Withdrawal Process Easily