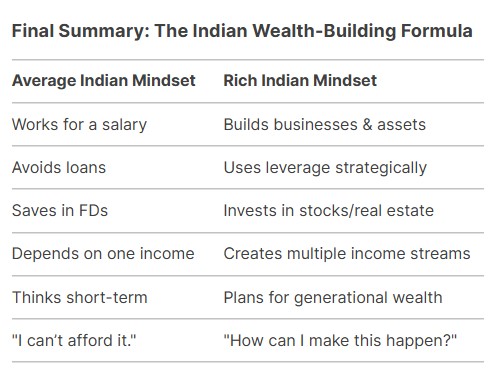

Rich vs Poor and Wealthy Indians from industrialists to startup founders don’t just earn money; they multiply it through smart strategies, calculated risks, and long-term thinking. Below is a detailed breakdown of how India’s richest build wealth, with real-world examples and powerful quotes.

1. Rich Focus on Assets, Not Just Income

Wealthy Indians prioritize buying assets (businesses, stocks, real estate) over-relying on salaries.

- Example:

- Ratan Tata didn’t just inherit wealth—he expanded the Tata Group by acquiring Jaguar Land Rover, Tetley, and Corus Steel, turning them into profit-generating assets.

- Radhakishan Damani (DMart founder) invested in real estate and equities, making him a billionaire beyond retail.

Quote:

“Don’t work for money, make money work for you.” — Warren Buffett

Key Takeaway:

- Average Indian: “How can I get a higher salary?”

- Rich Indian: “How can I own income-generating assets?”

2. Rich Use Leverage (OPM—Other People’s Money)

Rich Indians use loans, investors, and partnerships to scale faster.

- Example:

- Mukesh Ambani raised billions from global investors (Facebook, Google) for Jio instead of funding it all himself.

- Real estate tycoons (like DLF, Sobha) use bank loans to develop projects, selling them before repayment deadlines.

Quote:

“If you owe the bank 100, that’s your problem.If you owe the bank 100, that’s your problem.Ifyouowethebank100 million, that’s the bank’s problem.” — J.P. Morgan

Key Takeaway:

- Middle-Class: “I’ll save for 20 years to buy a house.”

- Rich: “I’ll get a loan, rent it out, and let tenants pay my EMI.”

3. Rich Think Long-Term & Compound Wealth

Patience + reinvestment = explosive growth.

- Example:

- Azim Premji held Wipro shares for decades, turning a small vegetable oil company into a $40B+ IT empire.

- Early investors in Infosys, TCS, or Reliance saw 100x+ returns by holding stocks for 20+ years.

Quote:

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

Key Takeaway:

- Average Investor: “I want quick profits from trading.”

- Rich Investor: “I’ll buy and hold great businesses for decades.”

4. Multiple Income Streams = Safety + Growth

The wealthy never depend on just one source.

- Example:

- Shah Rukh Khan earns from movies, IPL (Kolkata Knight Riders), brand endorsements, and real estate.

- Nandan Nilekani (Infosys co-founder) invests in startups (like Zerodha) beyond his core business.

Quote:

“Don’t put all your eggs in one basket.” — Indian proverb (followed by smart investors)

Key Takeaway:

- Salaried Employee: “My job is my only income.”

- Rich: “I have dividends, rent, business profits, and royalties.”

5. Solve Big Problems = Big Rewards

Scaling solutions for India’s masses creates massive wealth.

- Example:

- Dhirubhai Ambani made telecom affordable with Reliance Communications.

- Vijay Shekhar Sharma (Paytm) revolutionized digital payments in India.

Quote:

“If you solve a problem for millions, money follows automatically.” — Kunal Bahl

Key Takeaway:

- Middle-Class: “I’ll open a small shop.”

- Rich: “How can I disrupt an entire industry?”

6. Network with the Right People

Your circle influences your success.

- Example:

- Ratan Tata mentors startups (Ola, CureFit) and gains early investment opportunities.

- Anand Mahindra collaborates with global giants (Ford, Tesla) for joint ventures.

Quote:

“Your network is your net worth.” — Porter Gale (practiced by Indian biz leaders)

Key Takeaway:

- Average Person: “I don’t need connections.”

- Rich: “I actively seek mentors and partners.”

7. Never Stop Learning

The rich adapt to new trends (tech, markets, policies).

- Example:

- Rakesh Jhunjhunwala studied annual reports like a monk before investing.

- Nithin Kamath (Zerodha) educated retail investors via “Varsity” before scaling his brokerage.

Quote:

“An investment in knowledge pays the best interest.” — Benjamin Franklin (quoted by Indian investors)

Key Takeaway:

- Poor: “I don’t have time to learn.”

- Rich: “I spend 1 hour daily mastering finance & trends.”

8. Take Smart Risks (Not Gambles)

Wealthy Indians assess risk vs. reward carefully.

- Example:

- Sunil Mittal (Airtel) bet on mobile telephony when few believed in it.

- Biyani (Future Group) expanded retail despite early failures.

Quote:

“Big risks = big rewards, but only if calculated.” — Radhakishan Damani

Key Takeways

- Risk-Averse: “What if I fail?”

- Rich: “What’s the worst-case scenario, and how do I manage it?”

9. Tax Optimization & Legal Structures

Smart structuring saves crores legally.

- Example:

- Startup founders register in GIFT City (tax benefits).

- Family businesses use trusts to reduce inheritance tax.

Quote:

“It’s not how much you earn, but how much you keep.” — Robert Kiyosaki

Key Takeaway:

- Salaried Employee: “I pay 30% tax and complain.”

- Rich: “I use HUF, LTCG, and biz expenses to minimize tax.”

10. Abundance Mindset

The rich see opportunities where others see lack.

- Example:

- Narayana Murthy started Infosys with ₹10,000—today it’s worth ₹6 lakh crore+.

- Falguni Nayar (Nykaa) left banking at 50 to build a beauty empire.

Quote:

“If you think you can, or you think you can’t—you’re right.” — Henry Ford (believed by Indian entrepreneurs)

Key Takeaway:

- Scarcity Mindset: “Money is hard to earn.”

- Abundance Mindset: “Wealth is everywhere—I just need the right strategy.”

Action Step:

Start with one strategy—invest in SIPs, network with successful people, or start a side hustle. As Ratan Tata says:

“Take the stones people throw at you, and use them to build a monument.”

Other article: Why Gold Allocation is Essential for Your Investment Portfolio?