Mutual funds have emerged as one of the most popular investment options for Indians over the past few decades. They offer a simple yet effective way to grow wealth by pooling money from multiple investors and investing it in a diversified portfolio of stocks, bonds, or other securities. But what exactly are mutual funds, and why are they gaining traction in India? Let’s explore.

What is a Mutual Fund?

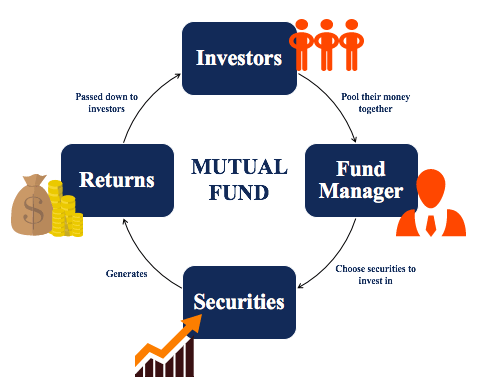

A mutual fund is a professionally managed investment vehicle that collects money from multiple investors with a common financial goal.

This pooled money is then invested in a variety of assets, including:

Equity (stocks): Shares of companies listed on stock exchanges.

Debt (bonds): Fixed-income instruments like government or corporate bonds.

Hybrid funds: A mix of equity and debt to balance risk and returns.

The returns generated from these investments are proportionally distributed among investors after deducting expenses such as management fees.

Why Are Mutual Funds Popular in India?

India’s growing economy and increasing financial literacy have made mutual funds a go-to investment choice for many. Here’s why:

Diversification: Investing in a single stock or bond can be risky. Mutual funds spread your investment across multiple assets, reducing risk.

Professional Management: Expert fund managers handle your investments, ensuring better decision-making based on market trends.

Affordability: You can start investing with as little as ₹500 through Systematic Investment Plans (SIPs).

Liquidity: Most mutual funds allow you to redeem your units anytime, offering flexibility when you need funds.

Tax Benefits: Certain mutual funds, like Equity Linked Savings Schemes (ELSS), provide tax deductions under Section 80C of the Income Tax Act.

Types of Mutual Funds

Mutual funds cater to various investor preferences and financial goals. Here are some common types:

Equity Funds: Invest primarily in stocks. Suitable for long-term growth but comes with higher risk.

Debt Funds: Invest in fixed-income securities. It is ideal for conservative investors seeking stable returns.

Hybrid Funds: Combine equity and debt to offer balanced risk and reward.

Index Funds: Track the performance of a specific index like the Nifty 50 or Sensex.

Sectoral Funds: Focus on industries like IT, banking, and healthcare.

How do you start investing in mutual funds in India?

Getting started with mutual funds is easy. Here’s a step-by-step guide:

Set Your Goals: Define your investment objectives, whether it’s wealth creation, saving for retirement, or buying a home.

Choose the Right Fund: Consider your risk appetite, time horizon, and goals before selecting a fund.

Complete KYC: Submit documents like a PAN card, Aadhaar, and a photograph to complete the Know Your Customer (KYC) process.

Select a Distributor or Platform: You can invest directly with Asset Management Companies (AMCs) or through a registered distributor like Fundsmart Finserv.

Start SIP or Lump Sum Investment: Decide between SIPs for regular small investments or lump sum for one-time large investments.

Benefits of Mutual Funds

Mutual funds offer a host of benefits that make them an appealing investment choice for Indians. Here’s an expanded list of key advantages:

1. Compounding Power

Mutual funds harness the power of compounding by reinvesting your earnings (dividends and capital gains). Over time, this allows your wealth to grow exponentially, especially when invested for the long term.

2. Inflation-Beating Returns

Equity-oriented mutual funds have the potential to deliver returns that surpass inflation, helping investors maintain and grow their purchasing power over time.

3. Transparency

Asset Management Companies (AMCs) disclose detailed reports about mutual fund holdings, performance, and expenses. This regular reporting enables investors to monitor their investments and make informed decisions.

4. Flexibility

Mutual funds offer unparalleled flexibility. You can:

Switch funds: Move your investments between different funds based on market conditions or personal goals.

Adjust SIP amounts: Increase or decrease your monthly contributions based on your financial capacity.

Choose investment styles: Opt for lump-sum investments or SIPs depending on your preferences.

5. Low Entry Barrier

You can start investing in mutual funds with as little as ₹100 – ₹500 through Systematic Investment Plans (SIPs). This affordability democratizes investing, allowing individuals from all financial backgrounds to participate.

6. Tax Efficiency

Tax-Saving Benefits: Equity Linked Savings Schemes (ELSS) allow tax deductions under Section 80C, up to ₹1.5 lakh annually.

Tax Treatment: Long-term capital gains on equity funds (above ₹1.25 lakh annually) are taxed at 12.5%, while short-term gains are taxed at 20%. Debt funds also have tax as per tax slab of the individuals/corporate.

7. Systematic Withdrawal Plans (SWPs)

In addition to SIPs, mutual funds offer SWPs, allowing investors to withdraw a fixed amount regularly. This feature is particularly useful for retirees seeking a steady income.

8. Goal-Oriented Investing

Mutual funds cater to specific financial goals such as:

Child’s education: Long-term equity funds help build a corpus for future expenses.

Retirement planning: Hybrid or balanced funds provide stability and growth for retirement savings.

Short-term needs: Debt funds are ideal for parking funds for short durations.

9. Liquidity

Mutual funds are highly liquid compared to investments like fixed deposits or real estate. Most funds allow you to redeem your units at any time, with the proceeds credited to your account within a few days.

10. Professional Fund Management

Mutual funds are managed by experienced professionals who actively monitor markets, rebalance portfolios, and make informed investment decisions to maximize returns.

11. Diversification

By pooling money from multiple investors, mutual funds invest in a variety of asset classes, industries, and geographies. This diversification reduces risk and enhances the potential for consistent returns.

12. Ease of Access

Digital platforms have made investing in mutual funds seamless. With apps and websites, investors can:

- Research funds.

- Track portfolios.

- Invest or redeem units anytime, anywhere.

13. Risk Mitigation

While all investments carry some level of risk, mutual funds mitigate these risks through diversification and professional management. Debt and hybrid funds offer lower-risk options for conservative investors.

Things to Keep in Mind

Market Risks: Returns are subject to market fluctuations.

Expense Ratios: Higher fees can eat into your profits. Choose funds with lower expense ratios.

Tax Implications: Gains from mutual funds are taxed. Equity funds attract short-term (20%) and long-term (12.5%) capital gains tax. Long Term gain exemption up to Rs.1.25 lakhs per financial year

Other Articles: