Transferring your Provident Fund (PF) from one employer to another is crucial to ensure your retirement savings remain consolidated and grow over time. Thanks to the Employees’ Provident Fund Organisation (EPFO), the process of transferring your PF has become more streamlined and can now be done online through the Unified Member Portal.

What is PF Transfer?

A Provident Fund (PF) transfer refers to the process of moving your accumulated PF balance from your previous employer to your current employer’s PF account. This PF transfer ensures continuity of your PF account, helping you maintain a single account for your retirement corpus. When you switch jobs, transferring your PF account online is a smart way to keep your savings together, avoid confusion, and maximize the interest earned.

Why Transfer Your PF?

Before diving into the process, it’s important to understand the benefits of transferring your PF:

Consolidation: Keeping all your retirement savings in one account helps you track your contributions and growth more easily.

Continuous Interest: A single account ensures that your funds earn uninterrupted interest, maximizing your retirement corpus.

Avoid Tax Implications: Transferring your PF instead of withdrawing it helps you avoid taxes on early withdrawals.

Streamlined Management: Managing one account is much simpler than juggling multiple accounts.

Eligibility for PF Transfer Online

To transfer your Provident Fund (PF) online, certain conditions must be met. Here’s a checklist of the eligibility criteria:

1. Activated UAN (Universal Account Number)

2. Linked Aadhaar with UAN

3. Mobile Number Registered with UAN

4. Bank Account Linked with UAN

5. Employer Approval

6. Only One Transfer Request at a Time

7. Previous PF Account in EPFO Database

Documents or Information Required for PF Transfer

When transferring your Provident Fund (PF) from one employer to another, having the correct documents and information is essential for a smooth process. Here’s what you need before initiating the transfer:

1. UAN (Universal Account Number)

2. Previous Employer’s PF transfer Account Details

3. Current Employer’s PF Account Details

4. Aadhaar Number

5. Bank Account Details

6. Mobile Number Registered with UAN

7. Form 13 (For Offline Process)

8. PAN (Permanent Account Number)

How to Transfer PF Online Easily?

Here’s how you can transfer your PF balance from your previous employer to your current employer online:

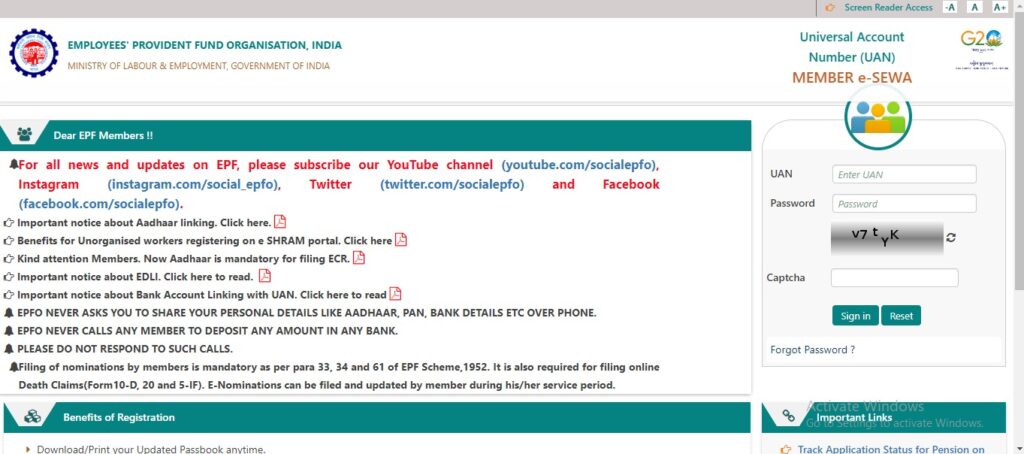

Step 1: Log in to the EPFO Member Portal

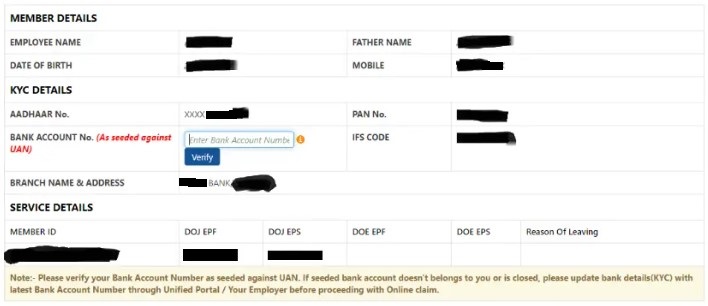

Step 2: Verify Personal Information

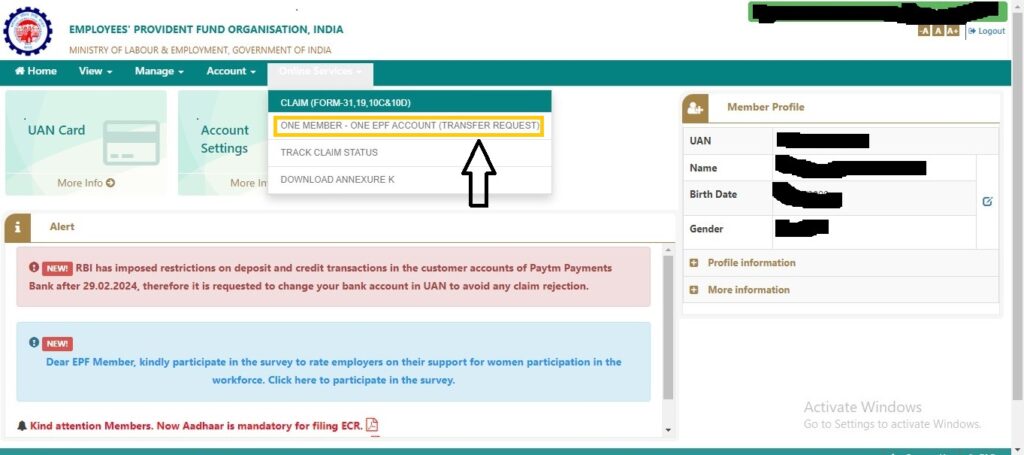

Step 3: Go to the “Online Services” Tab

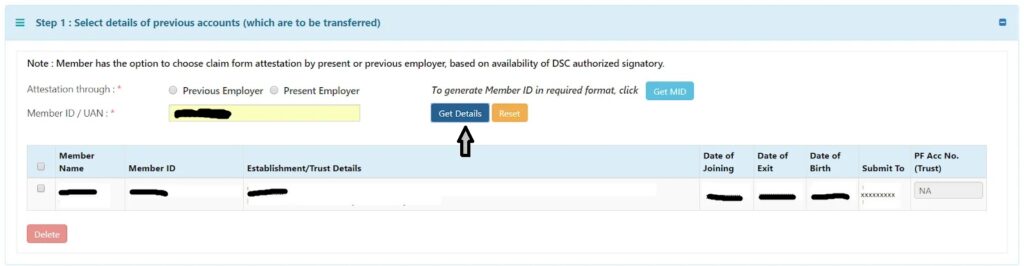

Step 4: Enter Your PF Transfer Details

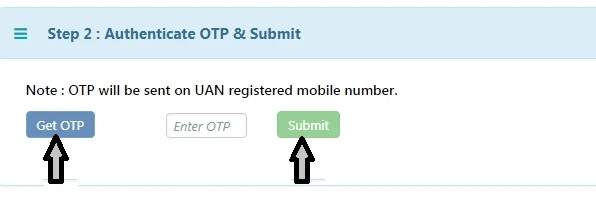

Step 5: Submit and Generate OTP

Step 6: Download the Transfer Claim Form

Step 7: Follow Up with Employer

Step 8: Track Claim Status

Conclusion

PF Transfer online is a seamless and efficient process that ensures your retirement savings remain consolidated, continue earning interest, and retain their tax-exempt status. By following the simple step-by-step guide outlined in this article, you can transfer your PF between employers with ease, saving time and avoiding complications. Consolidating your PF into one account allows for better financial management, streamlined tracking of your retirement savings, and a hassle-free withdrawal process when you eventually retire.

Taking advantage of the EPFO’s online transfer facility not only simplifies your financial planning but also secures your long-term financial future. Don’t overlook the importance of transferring your PF when changing jobs—ensure your retirement savings stay on track and continue to grow uninterrupted.

Other Articles:

EPF Withdrawal- How to Withdraw Your Provident Fund (PF) Online

PF Balance Check: How to Check Your EPF Balance with or without a UAN Number

EPF Claim Status: Check Your EPF Claim Status Online

6 Easy Ways to Find Your PF Account Number?

Frequently Asked Questions (FAQs)

What is a PF transfer?

A PF transfer involves moving your accumulated Provident Fund (PF) balance from one employer’s account to another when you change jobs.

Why should I transfer my PF?

Transferring your PF ensures continuity in your retirement savings, avoids tax implications, and allows your balance to keep earning interest.

Can I transfer my PF online?

Yes, the EPFO provides an online portal for easy PF transfers through the Unified Member Portal.

Who is eligible to transfer PF online?

You need to have an active Universal Account Number (UAN), Aadhaar linked to your UAN, and your mobile number registered with EPFO.

What documents are required to transfer PF?

You will need your UAN, previous and current employer’s PF account details, Aadhaar, bank account details, and mobile number registered with UAN.

How do I link my Aadhaar with my UAN?

You can link your Aadhaar with UAN by logging into the EPFO member portal and updating your KYC details.

How long does the PF transfer process take?

Once initiated, the PF transfer typically takes around 30-45 days to complete.

Do I need to inform my previous employer to transfer PF?

No, the request can be initiated online, and your previous employer will receive the transfer request electronically for verification.

Can I transfer PF without Aadhaar?

No, linking your Aadhaar with UAN is mandatory for an online PF transfer.

How can I check the status of my PF transfer?

You can check the transfer status by logging into the EPFO member portal and selecting the “Track Claim Status” option.

Is there a fee for transferring PF online?

No, the EPFO does not charge any fee for transferring your PF online.

What happens if I don’t transfer my PF?

If you don’t transfer your PF, the inactive account will stop earning interest after three years, and you may face tax liabilities if withdrawn early.

Can I transfer PF if I have multiple accounts?

Yes, you can consolidate multiple PF accounts into one by transferring the balances from each of your old accounts into your current PF account.

Can I transfer my PF if I have withdrawn some of the funds?

Yes, you can transfer the remaining balance after a partial withdrawal, as long as the PF account is still active.

Can I withdraw my PF instead of transferring it?

You can withdraw your PF, but doing so before five years of continuous service may result in tax liabilities. Transferring is generally the better option.

What is the role of UAN in PF transfer?

The Universal Account Number (UAN) is crucial for linking all your PF accounts across employers and is used to facilitate the transfer process.

Can I transfer PF from an exempted organization?

Yes, but the process may differ slightly. In this case, the exempted organization’s trust will handle the transfer, not EPFO directly.

Is it possible to transfer PF offline?

Yes, you can transfer PF offline by submitting Form 13 to your employer, though the online process is faster and more convenient.

What is Form 13 in PF transfer?

Form 13 is the form used for transferring PF from one employer to another. It can be generated online or submitted physically in the offline process.

What should I do if my transfer request is rejected?

If rejected, contact your employer or EPFO to resolve any issues, such as incorrect details or pending approvals, and reinitiate the process.

Can I transfer my PF if I’m no longer employed?

No, PF transfer can only occur if you are currently employed with a new organization contributing to your PF account.

How will I be notified about the progress of my PF transfer?

You will receive SMS updates on your registered mobile number regarding the approval and status of your PF transfer request.

Can I transfer my PF if my previous employer didn’t deposit contributions?

Yes, you can still transfer your PF, but it’s advisable to first resolve any discrepancies regarding missing contributions with your previous employer.

What if my previous employer no longer exists?

In such cases, EPFO will handle the verification process, but you may need to provide additional documentation to facilitate the transfer.

Can I transfer PF if my previous employer’s PF is maintained by a private trust?

Yes, but if your previous employer’s PF is managed by a private trust, the transfer will be handled between the trust and your current employer or EPFO, depending on the setup.