When filing a claim with the Employees’ Provident Fund Organisation (EPFO), a smooth claim process is the goal. Yet, small errors or inconsistencies can result in frustrating claim rejections. This guide will cover common reasons for EPF claim rejections and practical solutions to ensure your claim is accepted without delays.

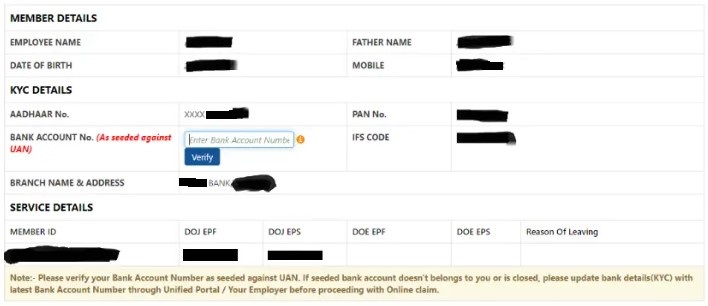

1. Incomplete KYC Details

One of the primary reasons claims are rejected is due to missing or outdated KYC (Know Your Customer) details. If essential information like Aadhaar, PAN, or bank account details are incorrect or incomplete, EPFO may not process your claim.

How to Fix It:

✔ Regularly update KYC details on the UAN portal and ensure they are verified by your employer.

2. Missing Annexure K for PF Transfers

While transferring your Provident Fund from an exempted trust to an

EPFO-managed account, it is important for you to have Annexure K with you. An absence of this document may be one of the primary reasons why your PF transfer can be either delayed or rejected.

How to Fix It:

✔ Request Annexure K from your previous employer or the EPFO while transferring your PF. This ensures a smooth transfer between different PF trusts.

3. Non Linking Of UAN With Aadhaar Card

The Universal Account Number (UAN) must be linked with your Aadhaar for verification purposes. A claim will likely be rejected if this link is missing.

How to Fix It:

✔ Link your UAN with Aadhaar on the EPFO portal EPFO portal. Make sure the Aadhaar-linked mobile number is active for OTP verification

4. Ineligible EPS Account

If your basic monthly salary is more than ₹15,000, your Employee Pension Scheme (EPS) account may not be eligible. The plan has a salary eligibility limit, so exceeding it can cause issues with your claim.

How to Fix It:

✔ Confirm that your EPS estimate is still valid before making any requests. If you exceed the salary cap, discuss your options with your boss or employer or financial advisor.

5. Mismatch in Personal Information

Discrepancies between your EPFO records and personal documents like Aadhaar or PAN can lead to rejections. Common errors include mismatched names or incorrect birth dates.

How to Fix It:

✔ Keep personal details like your name and birthdate consistent across documents. Correct discrepancies via the UAN portal or with the help of your employer.

6. Failure to Transfer EPS Contributions

When you change jobs, it’s essential to transfer Employee Pension Scheme (EPS) contributions along with the EPF balance. Not transferring EPS can result in complications.

How to Fix It:

✔ Ensure EPS contributions are transferred, and obtain a pension certificate when changing jobs.

7. Errors in the Claim Form

Small mistakes in filling out the claim form can result in rejection.

How to Fix It:

✔ Carefully review every detail on your claim form before submission, ensuring all information is accurate and up-to-date.

8. Incorrect UAN on the Claim Form

A claim will be rejected if the UAN on your claim form does not match EPFO records. This issue can arise if you have more than one UAN due to job changes.

How to Fix It:

✔ Consolidate multiple UANs into one by submitting a request on the UAN portal before filing any claims.

9. Incorrect Dates of Joining or Leaving

A mismatch in employment dates between EPFO records and your claim form will lead to rejection.

How to Fix It:

✔ Verify dates of employment on your EPFO passbook. Have your employer update any inaccuracies before filing a claim.

10. Bank Account Details Mismatch

If your bank account information on EPFO records, including account number, IFSC code, or branch name, is incorrect, the claim will be rejected.

How to Fix It:

✔ Double-check that your bank details on the UAN portal are current and match your active account.

11. Incorrect Employer Information

Errors in the employer’s details, such as establishment name or code, are common for those who have switched jobs frequently.

How to Fix It:

✔ Verify that your employer’s details are accurate on the EPFO portal before submitting your claim.

Tips to Ensure a Smooth EPF Claim Process

To reduce the likelihood of your EPFO claim being rejected, take these preventive steps:

Check for Data Mismatches: Ensure your EPFO records match your Aadhaar and other key documents.

Link UAN with Aadhaar: Make sure your UAN is linked with Aadhaar, and keep the Aadhaar-linked mobile number active.

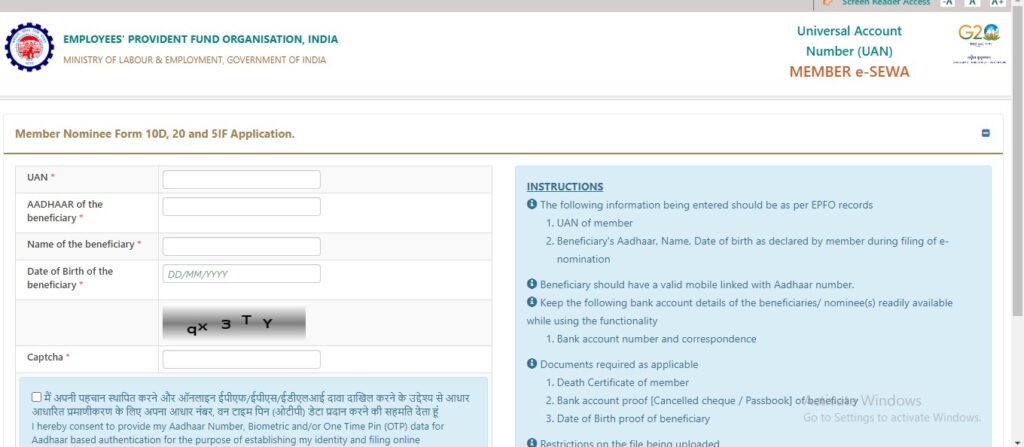

Update PF Nominations: Maintain up-to-date nominations to avoid complications with family claims.

Verify Employment History: Make sure there are no gaps or overlaps in employment records that could hinder your claim.

Double-Check Bank Account Details: Verify your account number, IFSC code, and branch details.

Transfer EPS Contributions: When changing jobs, always transfer EPS and obtain the pension certificate.

Review the Claim Form Thoroughly: Carefully go over all details before submission to ensure accuracy.

Keep Copies of All Documents: Retain copies of all claim submissions and employer attestations for future reference.

By following these steps, you can reduce the likelihood of your EPF claim being rejected and ensure a hassle-free experience.

Conclusion

Though the EPF claim process may seem straightforward, small errors can lead to frustrating delays. To prevent issues, keep your KYC details updated, link your UAN with Aadhaar, verify personal and employment information, and double-check your claim form. These steps will help ensure your claim is processed without complications. If you encounter any issues, reach out to your employer or EPFO support for help. Taking these proactive steps can save time and reduce stress during the EPF claim process.

Other Articles:

PF Balance Check: How to Check Your EPF Balance with or without a UAN Number

EPFO Grievance: Step-by-Step Guide to Registering Your Grievance with EPFO

EPF Transfer – How To Transfer PF Online Easily?

6 Easy Ways to Find Your PF Account Number?

EPF Claim Status: Check Your EPF Claim Status Online

Frequently Asked Questions (FAQs)

1. Why do EPF claims get rejected?

EPF claims often get rejected due to issues such as incomplete KYC details, UAN not linked with Aadhaar, mismatched personal information, incorrect bank details, or errors in the claim form.

2. How can I verify if my UAN is linked with Aadhaar?

You can check the status of your UAN-Aadhaar linking by logging into the UAN Member e-Sewa portal and navigating to the “Manage” section.

3. What happens if my personal details don’t match the EPFO records?

A mismatch in personal details, like name or date of birth, will result in claim rejection.

4. How do I update my KYC details in EPFO?

You can update your KYC details on the UAN portal by uploading documents like Aadhaar, PAN, and bank details for verification.

5. My EPF claim was rejected due to incomplete KYC. What should I do?

If your claim was rejected due to incomplete KYC, you need to update your KYC details on the UAN portal, ensure they are verified, and resubmit your claim.

6. Can I submit an EPF claim if I have more than one UAN?

No, multiple UANs must be consolidated into one before you can file a claim.

7. How do I consolidate multiple UANs?

To merge multiple UANs, submit a request on the EPFO portal or contact your employer for assistance.

8. What if my bank account details are incorrect in EPFO records?

Incorrect bank details will cause your claim to be rejected.

9. Can I withdraw my EPF without linking Aadhaar to UAN?

No, Aadhaar linking is mandatory for EPF withdrawals.

10. What should I do if my date of joining or leaving is incorrect?

Request your employer to update the correct information in EPFO records before submitting your claim.

11. How long does it usually take to process an EPF claim?

EPF claims typically take 10-20 working days to process if all details are correct.

12. What happens if my employer details are incorrect in EPFO records?

Incorrect employer details can lead to claim rejection.

13. Can I file an EPF claim if I haven’t transferred my EPS contributions?

You need to transfer your EPS contributions to your new employer’s EPF account to be eligible for pension benefits.

14. My EPF claim was rejected after switching jobs multiple times. What should I do?

Check that all previous employer details are updated, transfer EPS contributions, and consolidate UANs if applicable.

15. Is there an upper salary limit for EPS contributions?

Yes, if your basic salary exceeds ₹15,000 per month, your EPS contributions may no longer be eligible.

16. What is Annexure K, and when do I need it?

Annexure K is required when transferring Provident Fund from an exempted trust to an unexempted EPF account and can be obtained from your previous employer.

17. How can I prevent delays in my EPF claim process?

Ensuring your KYC, personal, and bank details are accurate and up to date can prevent delays.

18. What happens if there’s a gap in my employment history?

A gap in employment history may cause complications in your EPF withdrawal process.

19. Can I withdraw both EPF and EPS simultaneously?

Yes, you can withdraw both EPF and EPS at the same time, provided your EPS contributions have been transferred.

20. What documents are needed to submit an EPF claim?

You will need documents like your UAN, Aadhaar, PAN, and bank details, along with any other relevant papers such as a pension certificate or Annexure K.

21. How do I track my EPF claim status?

You can check the status of your EPF claim through the UAN Member e-Sewa portal under the “Track Claim Status” section.

22. What should I do if my EPF claim gets rejected multiple times?

Review the reasons for rejection, update the necessary details, and resubmit the claim.

23. Can I file an EPF claim online?

Yes, you can submit an EPF claim online through the UAN Member e-Sewa portal once your KYC details are verified.

24. What should I do if I can’t obtain my pension certificate?

You will need to contact your previous employer or the EPFO to obtain a pension certificate for EPS claims.

25. What if I lose my EPF claim acknowledgment?

Log into the UAN portal to track your claim using your UAN.