Dealing with issues related to your Employees’ Provident Fund (EPF) can sometimes be frustrating, whether it’s a delay in transfer, incorrect withdrawal amounts, or trouble accessing your EPF passbook. Fortunately, the Employees’ Provident Fund Organization (EPFO) provides a structured and easy way for employees to register their grievances. In this blog, we’ll walk you through the steps to lodge your complaint and ensure that your concerns are addressed effectively.

What is EPFO Grievance Redressal?

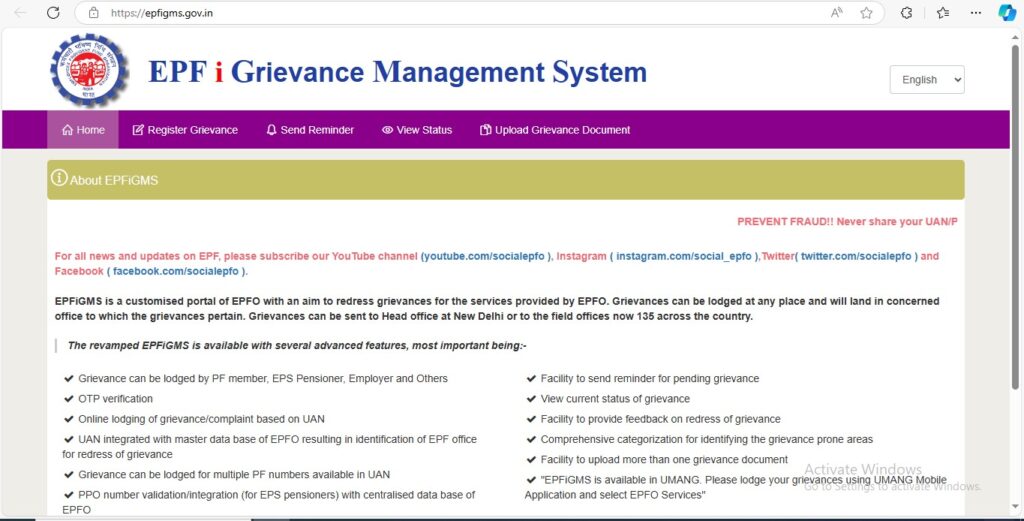

EPFO’s grievance redressal system allows employees and members of the EPF to file complaints related to EPF accounts, withdrawals, transfers, pension, or any other service-related issues. The online system, known as EPFiGMS (EPFO Grievance Management System), is designed to simplify the process for employees to register complaints without having to visit the EPFO office in person.

Common Issues You Can Register an EPFO Grievance

The Employees’ Provident Fund (EPF) is a crucial retirement savings scheme for millions of employees across India. While the Employees’ Provident Fund Organization (EPFO) manages the system efficiently, it’s not uncommon for employees to face occasional issues with their EPF accounts. Whether it’s related to withdrawals, transfers, or pension claims, EPFO provides a grievance redressal mechanism that allows employees to raise complaints.

1. Delayed or Failed EPF Withdrawals

- One of the most common issues EPF members face is the delay or failure in receiving their EPF withdrawals. This could happen due to:

If you’ve applied for a withdrawal and it hasn’t been processed within the expected timeline, you can raise a grievance to resolve the issue.

2. EPF Transfer Delays

When employees switch jobs, their EPF account needs to be transferred from their previous employer to their new one. Often, employees experience delays in this transfer process, which could be due to:

If your EPF balance hasn’t been transferred even after several months, you can file a grievance to expedite the process.

3. Incorrect EPF Balance or Missing Contributions

Sometimes, employees notice that their EPF balance doesn’t reflect the contributions made by them or their employer. This could be due to:

Raising a grievance can help resolve discrepancies in your EPF balance, ensuring that all contributions are properly credited.

4. Errors in EPF Passbook

Your EPF passbook is a record of all contributions and withdrawals made under your EPF account. Occasionally, members may encounter:

If your EPF passbook contains errors, you can register a grievance to have the records corrected.

5. Issues Related to Pension (EPS)

EPF members are also entitled to pension benefits under the Employees’ Pension Scheme (EPS). Common pension-related issues include:

If you’re facing pension-related difficulties, raising a grievance will allow EPFO to resolve these concerns.

6. Non-Receipt of Annual EPF Statement

EPF members should receive an annual statement showing the status of their EPF account, including total contributions and interest accrued. If you’ve not received your annual statement or it contains errors, you can file a grievance with EPFO to get this corrected.

7. KYC (Know Your Customer) Issues

For seamless EPF services like withdrawals and transfers, it’s mandatory to complete the KYC process by linking your Aadhaar, PAN, and bank account to your EPF account. Some of the common KYC-related issues include:

Raising a grievance helps expedite the KYC verification process or resolve any discrepancies.

8. Claim Rejection without Proper Justification

If you’ve submitted a claim for withdrawal, pension, or transfer and it has been rejected without a clear reason, you have the right to file a grievance. Common reasons for claim rejections include:

A grievance will help you understand the reason for rejection and allow you to resubmit the claim with the correct information.

9. Issues with Updating Personal Information

If you need to update personal information such as your name, date of birth, or contact details in your EPF account, it must be done through the EPFO portal. However, issues can arise such as:

You can file a grievance to ensure that your personal details are accurately updated in the EPFO grievance system.

10. Employer-Related Issues

Sometimes, employees may face issues directly related to their employer’s handling of EPF, such as:

If your employer is not complying with EPF regulations, you can file a grievance to have EPFO address the issue.

Step-by-Step Guide to Registering Your Grievance with EPFO

Step 1: Access the EPFO Grievance Management Portal

Start by visiting the official EPFO grievance portal EPFO Grievance Management System. This portal allows EPF account holders to submit complaints online.

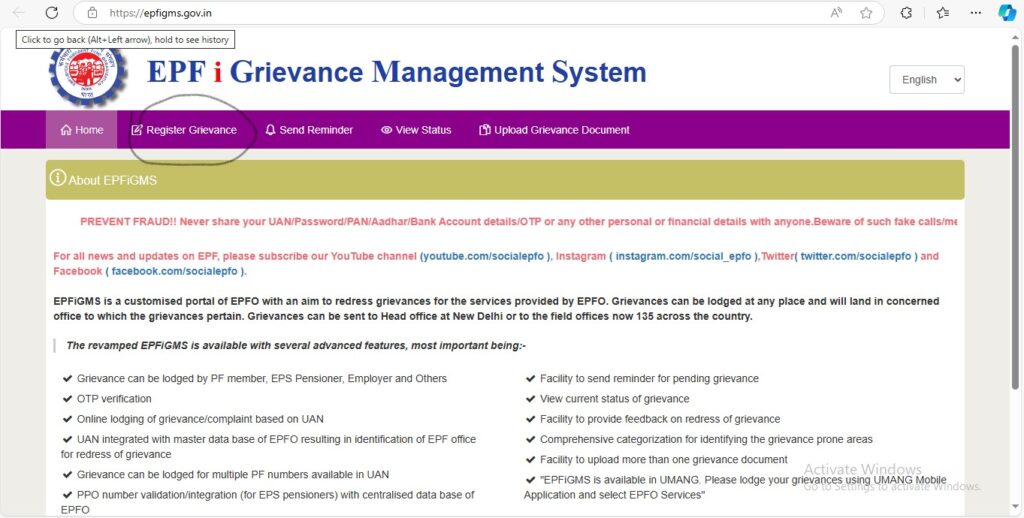

Step 2: Select “Register Grievance”

On the homepage, click on the option that says “Register Grievance.” This will take you to a form that allows you to register a new complaint.

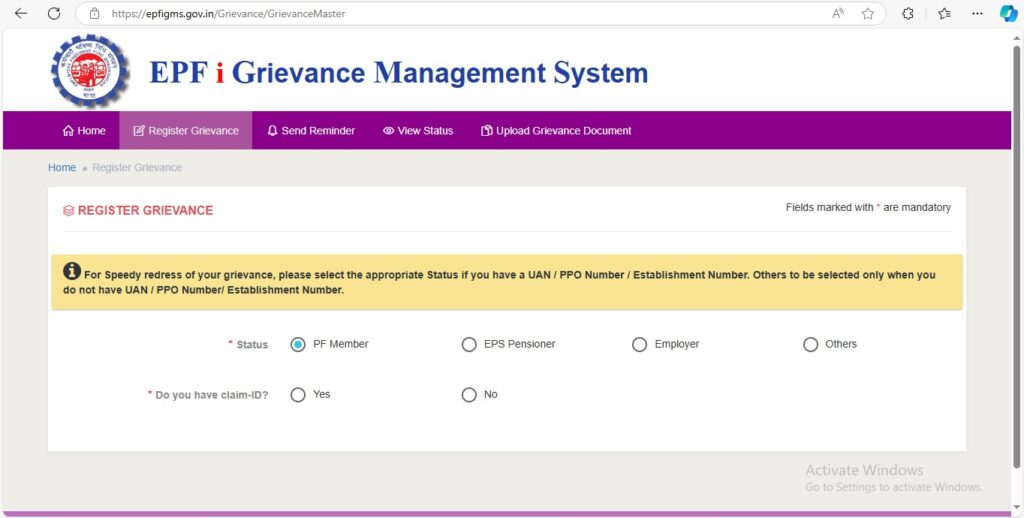

Step 3: Choose Your Status

You will be asked to select your status from the following options:

Select “PF Member” if you are an employee facing issues with your EPF account.

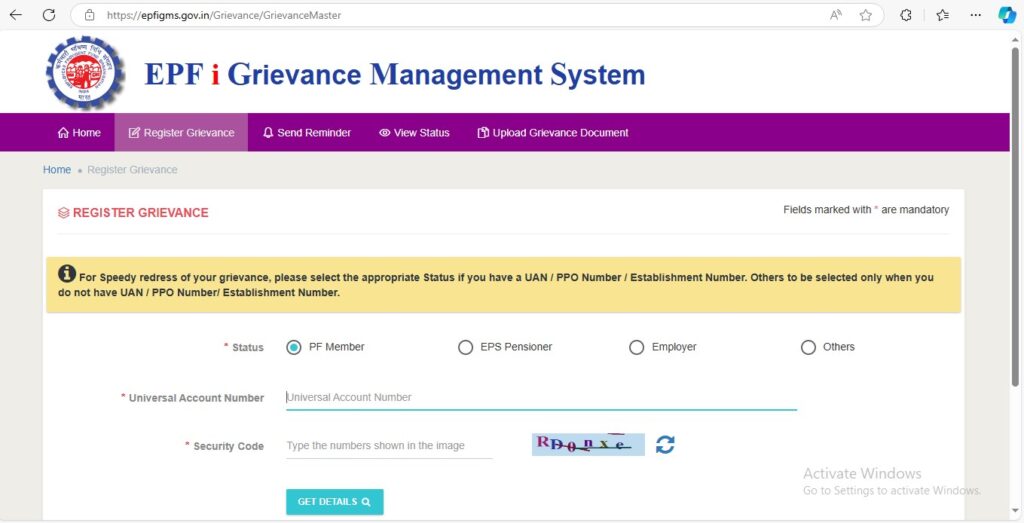

Step 4: Enter Your UAN (Universal Account Number)

Once you’ve selected your status, you’ll need to enter your UAN (Universal Account Number) and click on ‘Get Details.’ Scroll down to view the UAN details displayed on the screen click on the Get OTP button. Your personal details, including your name, date of birth, and other account information, will be auto-filled based on your UAN.

Note: Ensure that your UAN is activated before proceeding. If it’s not, you can activate it via the EPFO member portal.

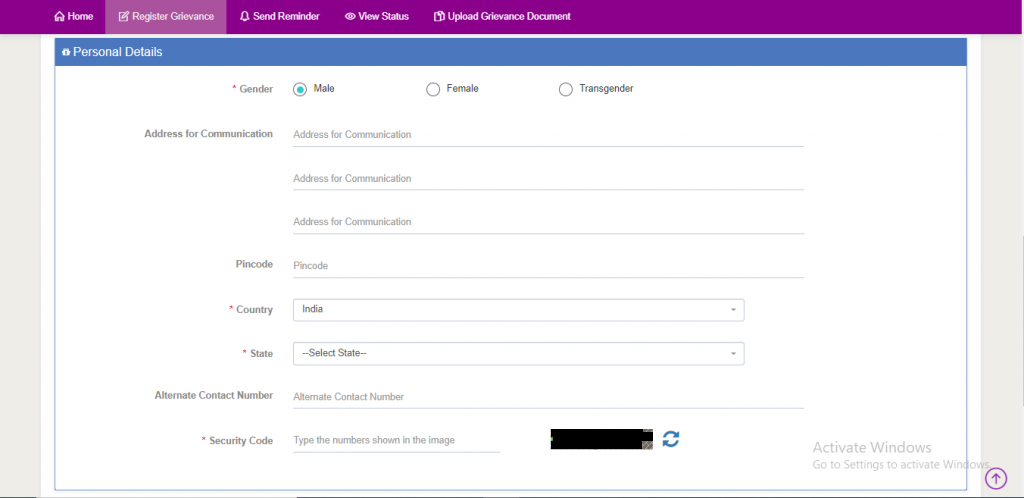

Step 5: Provide Necessary Details

After entering your UAN, fill in the rest of the form, which includes:

Be sure to provide clear details about the issue you are facing.

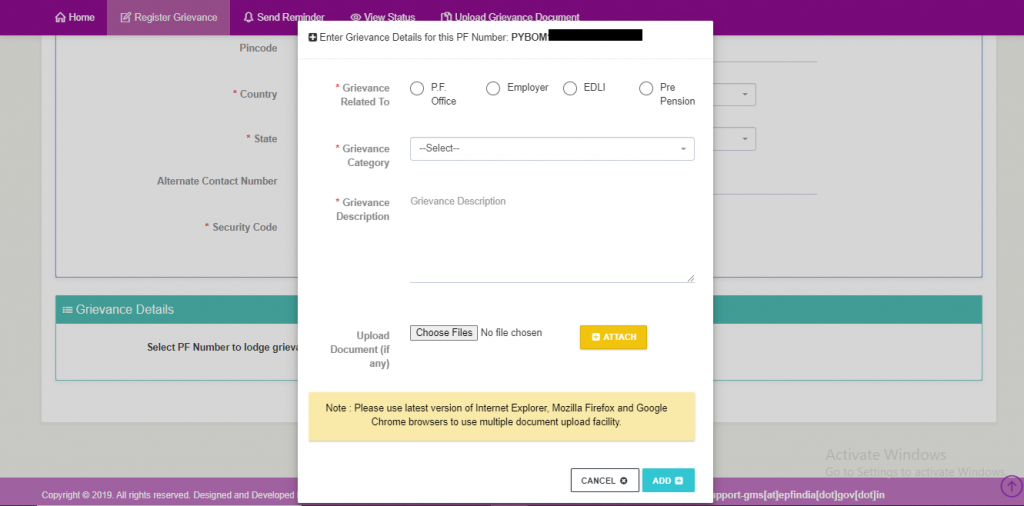

Step 6: Attach Supporting Documents (Optional but Recommended)

If you have any documents that can support your EPFO grievance (such as screenshots, previous correspondence, or any proof of issue), you can upload them on the portal. This will help expedite the resolution process.

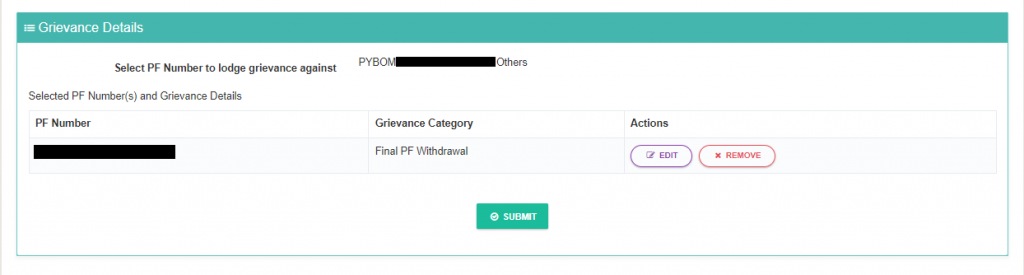

Step 7: Submit the Grievance

After filling out all the necessary details and attaching any documents, review the information you have entered and click “Submit.” You will receive a reference number for tracking your grievance.

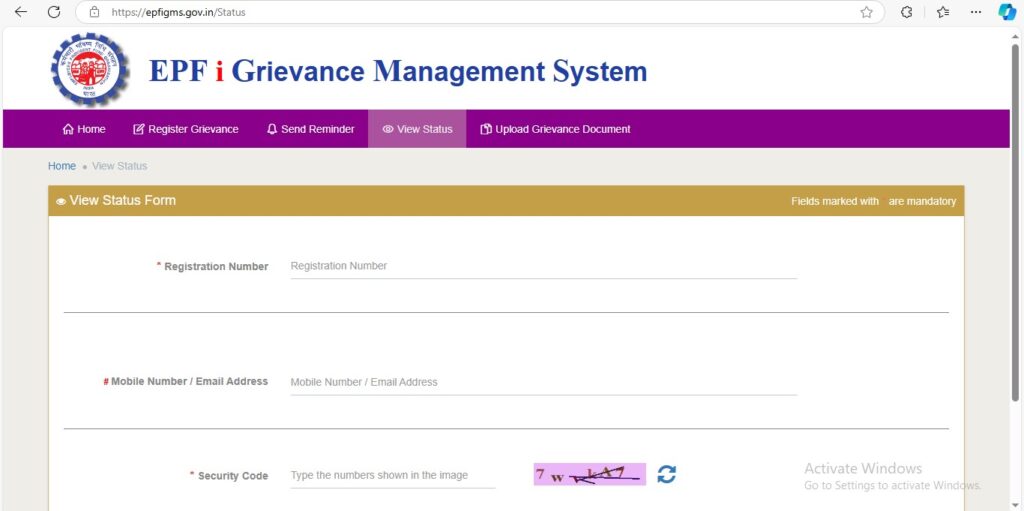

Step 8: Track Your Grievance

Once your grievance is registered, you can track the status using the ‘View Status’ option on the EPFO Grievance Management portal. Enter your reference number and other required details to check the progress of your complaint.

Step 9: Resolution of Your Grievance

Once your EPFO grievance is processed, the concerned EPFO office will address your complaint and take necessary action. The EPFO generally aims to resolve complaints within 30 days. However, this timeline may vary depending on the nature of the issue.

You can also escalate the complaint if it’s not addressed within the specified timeframe by contacting the EPFO grievance office directly or approaching higher authorities like the Regional Provident Fund Commissioner.

Tips for Ensuring a Smooth EPFO Grievance Resolution:

Ensure Correct Information: Double-check all the details, such as your UAN, contact information, and the specific issue you’re raising.

Upload Clear Documents: If you’re attaching documents, make sure they are clear, legible, and directly relevant to the issue.

Follow-up: Don’t hesitate to follow up if you feel there’s a delay. Use the reference number to track your grievance regularly.

Escalate If Necessary: If your issue is unresolved, you can escalate it by contacting EPFO Grievance customer care or visiting the regional office.

Other Articles:

EPF Transfer – How To Transfer PF Online Easily?

PF Balance Check: How to Check Your EPF Balance with or without a UAN Number

EPF Claim Status: Check Your EPF Claim Status Online

6 Easy Ways to Find Your PF Account Number?

EPF Withdrawal- How to Withdraw Your Provident Fund (PF) Online

Frequently Asked Questions (FAQs)

What is the EPFO Grievance Management System?

The EPFO Grievance Management System (EPFiGMS) is an online platform that allows EPF members to file complaints related to their EPF accounts, pensions, or employer-related issues.

Who can file a grievance with EPFO?

Any EPF member, EPS pensioner, or employer can file a grievance related to EPF services.

What are the most common issues you can file a grievance for?

Some common issues include delayed withdrawals, transfer of funds, errors in passbook, missing contributions, KYC problems, and pension-related issues.

How do I file a grievance with EPFO?

You can file a grievance online by visiting EPFiGMS, selecting your status, entering your UAN, and submitting details about your issue.

Do I need to have my UAN to register a grievance?

Yes, having an active UAN (Universal Account Number) is necessary to register EPFO grievance.

What documents should I attach when registering a grievance?

You can attach relevant documents such as EPF passbook copies, previous correspondence, screenshots, bank details, or any other evidence that supports your claim.

Can I track the status of my grievance?

Yes, you can track your grievance status online by visiting the EPFiGMS portal and using the reference number provided after submitting the grievance.

What is the expected resolution time for an EPFO grievance?

EPFO generally aims to resolve grievances within 30 days, but this can vary depending on the complexity of the issue.

What should I do if my grievance is not resolved within the stipulated time?

You can follow up by tracking your grievance status online or escalate it by contacting EPFO customer care or visiting the nearest EPFO office.

Can I register a grievance for EPF transfer delays?

Yes, if your EPF transfer request has been delayed, you can file a grievance to expedite the process.

How can I correct errors in my EPF passbook?

If your EPF passbook contains incorrect or missing entries, you can file a grievance and provide details about the discrepancies.

What are the common reasons for EPF claim rejections?

Common reasons include incomplete documentation, KYC mismatches, incorrect bank details, or pending employer approvals.

How can I resolve pension-related issues with EPFO Grievance?

You can register a grievance for pension-related issues such as delayed payments, incorrect pension amounts, or problems with your Pension Payment Order (PPO).

Is it possible to change personal details like name or date of birth through a EPFO grievance?

Yes, you can file a grievance if you’re facing difficulties in updating personal information like name, date of birth, or contact details in your EPF account.

How do I resolve KYC issues with EPFO Grievance?

If there are issues with KYC verification or linking your Aadhaar, PAN, or bank details, you can file a grievance to resolve them.

Can I file a grievance if my employer hasn’t deposited my EPF contributions?

Yes, you can file a grievance if your employer hasn’t deposited EPF contributions or if there are discrepancies in the amount deposited.

What should I do if I haven’t received my EPF annual statement?

You can raise a grievance with EPFO if you haven’t received your annual statement, or if the statement contains errors.

Can I file a EPFO grievance if my bank account details are incorrect in the EPF system?

Yes, if your bank account details are incorrect or outdated in EPFO records, you can file a grievance to update them.

How can I escalate an unresolved grievance?

You can escalate an unresolved grievance by contacting the Regional Provident Fund Commissioner or higher authorities within the EPFO.

Can employers register grievances with EPFO?

Yes, employers can file grievances related to EPF administrative issues, such as errors in employee data or contribution records.

Is there a fee for filing a grievance with EPFO?

No, filing a grievance with EPFO is completely free.

Can I withdraw my EPFO grievance after filing it?

No, once a grievance is filed, it remains in the system for resolution, but you can clarify or update information if needed.

What happens after I submit a grievance?

After submitting a grievance, it will be forwarded to the relevant EPFO office for review and resolution. You will receive updates through the grievance tracking system.

How will I be notified of my grievance resolution?

EPFO will notify you through email or SMS, and you can also track the status online to check for resolution updates.

Can I file multiple grievances for different issues?

Yes, if you are facing different issues, you can file separate grievances for each concern to ensure they are addressed individually.